Struggling to stay on top of your finances? A budget is your key to success! But before we dive into the 4 common types of budgeting methods, let’s break down what a budget actually is.

Think of a budget as your spending plan. It helps you organize your income and expenses, keeping track of where your money goes. It’s your tool to live within your means, avoid overspending, and achieve your financial goals. And guess what? Budgets don’t have to be restrictive!

However, there’s no one-size-fits-all approach. Here are four popular types of budget methods to consider:

-

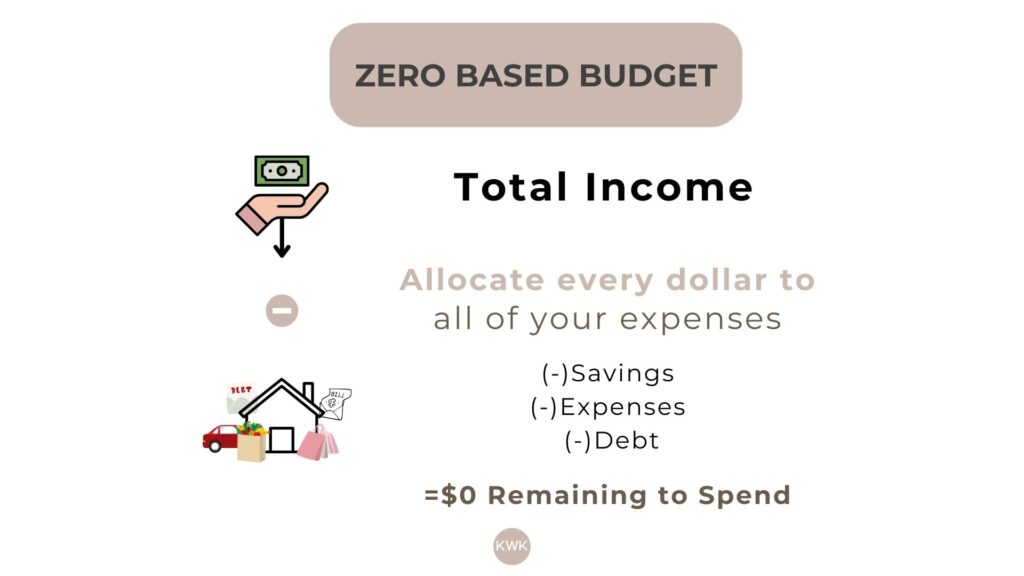

Zero-Based Budgeting: Every Dollar Has a Job

This method assigns every dollar you earn a specific purpose. The goal isn’t to spend everything, but to allocate each dollar to a job (category), like savings, bills, groceries,entertainment, or debt repayment. This way, you know exactly where your money is going.

Who should use it?

- Meticulous planners

- People who want to curb overspending

- Individuals aiming to boost savings or pay off debt quickly

Now, the Zero-Based Budget (ZBB) method… this one is my absolute favorite! For someone like me who used to mindlessly spend on shopping, ZBB was a game-changer. Assigning every dollar a job forced me to be more intentional with my spending, and guess what? I started saving and investing way more!

Want to learn more about the Zero-Based Budget method? Check out my in-depth guide here.

Download your FREE Zero-Based Budget Template (Google Sheet) today and get started on your budgeting journey! Check it out here.

-

Pay Yourself First: Prioritize Savings

This method flips the script. Instead of spending everything and saving what’s left, you “pay yourself first” by automatically allocating a set amount to savings before you even touch your remaining income.

Who should use it?

- Hands-off budgeters who prioritize saving and investing

- People who struggle with spending temptations

Fun fact, I actually use a combination of the Pay Yourself First method and Zero-Based Budgeting (ZBB). Whenever I create my ZBB plan, I allocate a set amount towards my savings and investments first. Then, I allocate the rest of my income to fixed and variable expenses with what’s left.

-

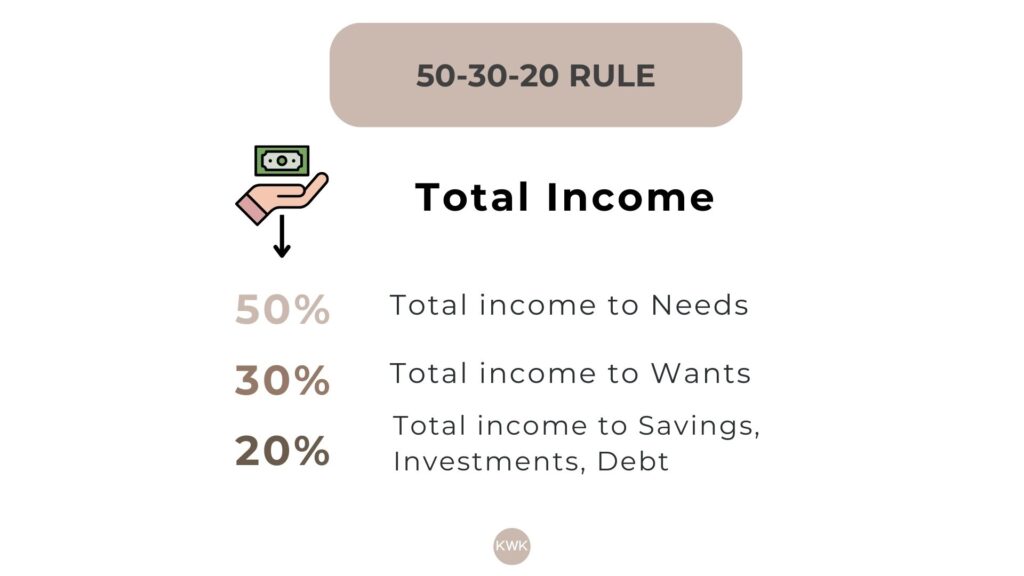

50/30/20 Rule: A Simple Breakdown

This method is all about percentages. You divide your income into three main categories:

- 50%: Fixed expenses (housing, utilities, groceries, etc.)

- 30%: Wants (dining out, entertainment)

- 20%: Savings, investments, and debt repayment

Who should use it?

- People who want a straightforward approach with clear guidelines

I personally found the 50/30/20 rule to be a great starting point, but the percentages are not set in stone, you can adjust them! If you’re like me and want to treat yourself occasionally while still making saving a priority, this rule is super flexible. For example, bump up your savings to 30% and cut back your “wants.”

-

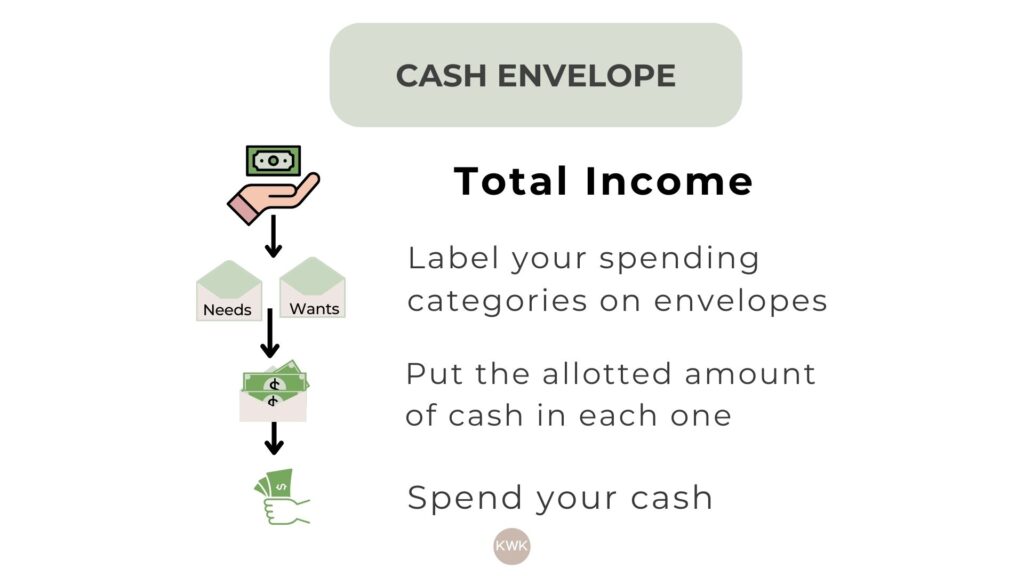

Cash Envelope System: Take Control with Physical Cash

This method involves dividing your income into spending categories and allocating physical cash to each category in separate envelopes. Once the cash in an envelope runs out, your spending in that category stops for the period.

Who should use it?

- Individuals who struggle with sticking to digital budgets

Remember: Budgeting takes a little bit of work in the beginning. Don’t be discouraged if you make mistakes! Expect to tweak your budget as you go to find the perfect fit. If you haven’t found a budgeting method that you like after a few months, try a different one! You got this!?

Also Read: 9 Healthy Financial Habits You Need to Better Your Financial Future