Do planned expenses ever feel like they sneak up on you, even when you know they’re coming?

Holiday season, birthdays, an upcoming vacation, annual bills, or that car repair somehow always show up at the worst time.

Here’s the thing: those expenses usually aren’t surprises. We just weren’t taught how to plan for them.

That’s where sinking funds come in.

Sinking funds are a simple way to save small amounts of money over time for expenses you know are coming. Instead of scrambling when the bill shows up, you’re already prepared.

In this post, I’ll show you how to start sinking funds step-by-step, even if you’re starting with very little.

By the end, you’ll know exactly how to set them up, what categories to use, how much to save, and how to make this work in real life.

What Is a Sinking Fund?

A sinking fund is money you save ahead of time for a specific expense you already know is coming.

Instead of saying, “I’ll figure out how to pay for it when it happens” you’re saying,

“I know this is coming, so I’m going to prepare for it little by little.”

Some common sinking fund expenses include:

- Travel

- Gifts and holidays

- Car maintenance

- Wedding

- Home repairs

- Medical costs

- Annual bills like subscriptions or insurance

When the expense shows up, the money is already there.

You don’t panic. You can choose to use your credit card to earn points and pay it off right away, or just pay straight from your bank account.

One quick note: sinking funds are not the same as an emergency fund.

Emergency funds are for unexpected situations. Sinking funds are for planned ones.

Why Sinking Funds Matter (Even If You’re Starting With a Small Amount)

Some people hear “sinking funds” and assume they only work if you have extra money to save.

But sinking funds aren’t about leftover money. They’re about setting money aside on purpose for expenses you already know are coming, so they don’t throw off your budget when they show up.

Instead of one big bill hitting all at once, sinking funds let you spread the cost over time. When the expense comes up, the money is already there.

You’re not trying to figure it out at the last minute, stretching yourself too thin that month, or putting it on a credit card just to deal with it later.

In my experience, sinking funds completely changed how I handled planned expenses. Once I added them to my budget, they became non-negotiable. Having money set aside ahead of time meant I wasn’t pulling from my general savings or cutting things out that month when a bigger expense came up.

This works even if you’re starting small. Saving $50 or $100 a month may not feel like much, but it adds up faster than you think. Even if it doesn’t cover the full expense, it still helps offset the cost when that bill shows up.

More importantly, it builds the habit. You start expecting and planning for these expenses instead of being surprised by them.

Sinking funds don’t magically create more money, but they give you more control. You’re spreading the cost out over time instead of taking one big hit all at once.

How to Start Sinking Funds (Step-by-Step)

Step 1: List Your Planned Expenses

Write down expenses you know are coming.

Common examples:

- Car repairs or maintenance

- Travel or vacations

- Gifts (birthdays, holidays, weddings)

- Wedding fund (you’re getting married)

- Medical or dental costs

- Annual or semi-annual bills

If it helps, ask yourself:

“What expenses keep catching me off guard every year?”

That’s your starting list. You don’t need to include everything at once. Even starting with just a few planned expenses is enough.

Step 2: Decide How Much You Need and When You’ll Need It

For each planned expense, write down two things:

- How much the expense will cost

- When you’ll need to pay for it

That’s it. This becomes your sinking fund goal.

Examples:

- $700 travel fund by this August 2026

- $1,000 holiday gift fund by December 2026

- $10,000 wedding fund by September 2027.

Don’t overthink the number. A reasonable estimate works, and you can always adjust later once you see how it fits into your budget. Picking a timeline helps turn this into an actual plan instead of a vague goal.

Step 3: Calculate How Much to Save for Each Expense

Next, decide how much to save on a regular basis.

Take the total amount you want to save for each expense (from Step 2) and divide it by the number of months, paychecks, or weeks you have until you need to pay for it.

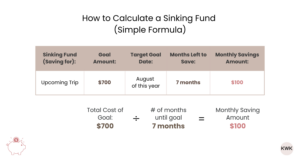

Example:

If you want to save $700 for travel by August, and it’s currently January, you have 7 months to save.

- $700/7 = $100 per month.

- $700/ 26 = $26.92 per week.

- $700/13 = $53.85 bi-monthly (twice a month)

That number is how much you’ll aim to save each time.

Tip: Think about how your paychecks and expenses actually line up. If most of one paycheck usually goes toward bills, splitting your sinking fund savings across your paychecks can feel more manageable.

Consistency matters more than the amount. You can always increase it later.

Here’s what this looks like when you put it all together:

Step 4: Include Your Sinking Funds in Your Budget

Add each sinking fund to your budget as its own line item, along with the amount you plan to save.

This makes sure the money is planned for and doesn’t get accidentally spent elsewhere. Whether you use a spreadsheet, an app, or pen and paper, your sinking funds should show up just like any other bill or expense.

From there, you’ll move that set amount into your sinking fund on a regular basis, whether that’s monthly or per paycheck.

Tip: If the amount feels tight, you can lower it or extend the timeline. If you find you have more room in your budget, increasing the amount can help you reach your goal sooner.

Step 5: Decide Where You’ll Keep Your Sinking Funds

Now that you know what you’re saving for and how much you plan to set aside, decide where your sinking funds will live.

Best option (recommended):

- High-yield savings account (HYSA)

- Earns more interest than a regular savings account

- Keeps your money accessible when you need it

You can also start with the savings account you already have or cash envelopes.

The goal is simple: keep this money separate from everyday spending so it’s there when you need it.

Step 6 (Optional): Automate Your Sinking Fund Savings

If possible, set up automatic transfers from your checking account to your sinking funds.

This helps by:

- Removing the temptation to spend the money

- Making saving consistent without thinking about it

Common Sinking Fund Categories (With Examples)

You don’t need a sinking fund for everything. Start with the categories that tend to throw off your budget when they come up.

Here are some common sinking fund categories, with simple real-life examples.

Gifts & Holidays

Birthdays, holidays, weddings, baby showers.

This lets you spread gift spending throughout the year instead of having it throw off your budget when multiple events come up.

Travel

Vacations, family visits, weekend trips.

Helps you plan for travel ahead of time instead of relying on credit cards or scrambling when the trip comes up.

Car Expenses

Maintenance, repairs, tires, registration, down payment.

Cars will need money eventually, even if nothing is wrong right now or you’re planning to buy one in the near future.

Home Expenses

Repairs, furniture, appliances, moving costs.

Keeps home-related costs from disrupting your budget when something expensive comes up.

Medical & Dental

Copays, prescriptions, Invisalign, deductibles.

Covers out-of-pocket costs that aren’t emergencies but still add up quickly.

Annual or Irregular Bills

Insurance premiums, subscriptions, memberships.

Helps prevent irregular bills from catching you off guard when they’re due.

Big Life Goals or Events

Wedding, home down payment, large family events.

Helps you save for major milestones over time, rather than scrambling when the expense is close.

How to choose your categories

If you’re unsure where to start, ask yourself:

- What expenses catch me off guard every year?

- What do I usually put on a credit card?

- What causes the most stress when it comes up?

Start with 2–5 categories. You can always adjust later.

Prefer to see this in action?

If you’re more of a visual learner, this short video walks through how sinking funds work using the steps above.

Want to Make this Even Easier? (Optional Tool)

If you like having things laid out clearly and don’t want to calculate or track everything manually, I created a Sinking Fund Google Sheets Tracker to help with that.

Instead of guessing how much to save or double-checking the math, the tracker:

- calculates how much to save based on your goal and timeline

- works with monthly, biweekly, or paycheck schedules

- tracks progress so you can actually see your savings grow with a simple click.

You enter your goals, choose your dates, and the spreadsheet tells you how much to set aside based on your schedule.

If you want help setting this up, my Sinking Fund Google Sheets Tracker walks you through it step by step.

Frequently Asked Questions About Sinking Funds

Here are answers to the most common questions people have when getting started.

How many sinking funds should I have?

Most people do well starting with 2–5 categories. You can always add more later as your budget allows.

What if I can only save $50 a month?

That’s okay. Pick one expense or goal you want to prepare for and start there. Progress is progress.

Are sinking funds different from an emergency fund?

Yes. Emergency funds are for unexpected emergencies. Sinking funds are for planned expenses.

How much should I put in sinking funds?

There’s no set number. How much you put in sinking funds depends on your income, timeline, and other priorities.

A simple way to decide is to take the total cost of the expense and divide it by the number of months, weeks, or paychecks you have until you need to pay for it.

If that amount feels too tight, adjust it. You can always increase it later. If you prefer not to calculate this manually, this sinking fund spreadsheet can help with that.

What are common sinking fund mistakes to avoid?

Creating too many categories at once, trying to fully fund everything immediately, or giving up after missing a month. Missing a month doesn’t mean you failed.

Saving something is always better than saving nothing.

Final Thoughts on Sinking Funds

Sinking funds aren’t just for people with high incomes. They’re about giving yourself a little breathing room so planned expenses don’t throw off your budget.

They also make bigger goals feel more doable. Whether you’re saving for your wedding, planning more travel, or working toward other bigger goals you don’t want to put off, breaking those costs into smaller, planned amounts makes them easier to manage.

Start simple. One or two categories is more than enough to begin. Over time, this makes managing your money easier and less stressful, and it helps you build better habits without overcomplicating things.