Choosing a debt payoff method can feel harder than actually making the payments. If you are trying to decide between the snowball vs avalanche method, the next question is usually how to choose the right one.

Both methods are proven ways to pay off debt, but they work differently and feel very different while you are using them.

Not all debt is the same, but when it comes to high-interest debt, like credit cards, having a payoff strategy matters. Interest can add up quickly, which is why having a clear plan makes such a difference.

In this post, I’m breaking down the snowball vs avalanche method in a simple way. We’ll look at how each method works, the pros and cons of each, and how to decide which one makes the most sense for you. The goal is to help you move forward with a plan that feels manageable and helps you make real progress over time.

What Is the Snowball Method?

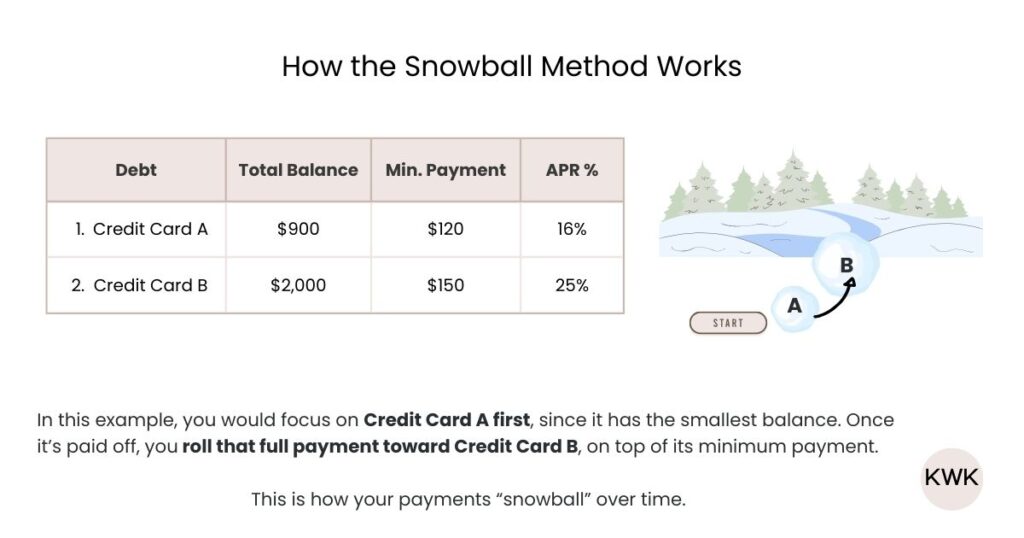

The snowball method focuses on paying off your smallest balance first, regardless of interest rate.

Here’s how it works:

- List all your debts from smallest balance to largest, including the minimum payment for each

- Pay the minimum on all debts except the one with the smallest balance

- Put any extra money toward the smallest balance

- Once that debt is paid off, roll that payment into the next smallest balance and add it to that account’s minimum payment

- Repeat this process until your debts are paid off

The idea is that paying off a balance early gives you a quick win. That early progress builds momentum and makes it easier to stay consistent.

The snowball method works well if:

- You need motivation early on

- Seeing balances disappear helps you keep going

- You’ve struggled to stick with a plan in the past

- Debt feels overwhelming and you want progress you can actually see

The snowball method is more about behavior and consistency than math.

What Is the Avalanche Method?

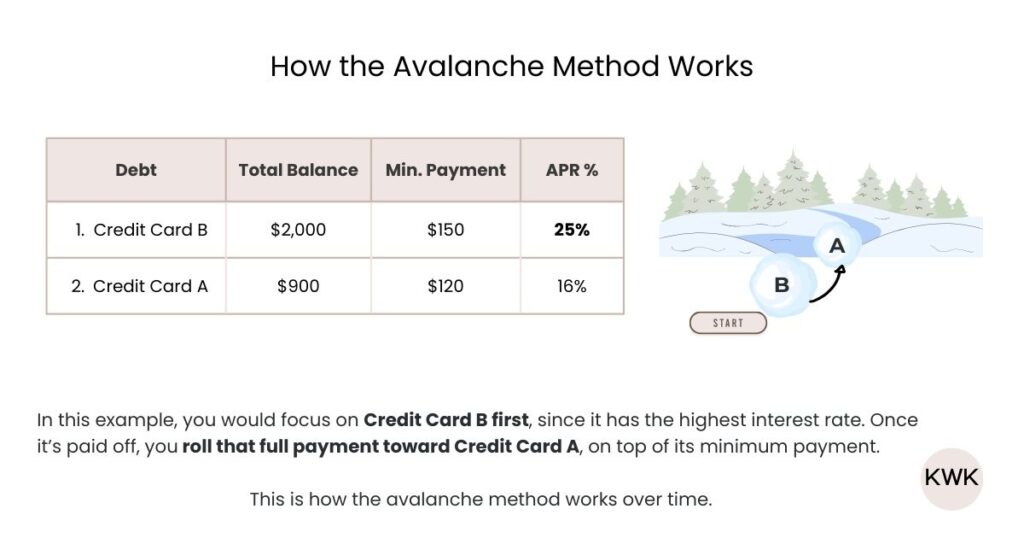

The avalanche method focuses on paying off the debt with the highest interest rate first, regardless of the balance.

Here’s how it works:

- List all your debts from highest interest rate to lowest, including the balance and minimum payment for each

- Pay the minimum on all debts except the one with the highest interest rate

- Put any extra money toward the debt with the highest interest

- Once that debt is paid off, roll that payment into the next highest interest rate debt and add it to that account’s minimum payment

- Repeat this process until your debts are paid

Because you are tackling the most expensive debt first, this method usually saves you more money over time by reducing how much you pay in interest.

The avalanche method works well if:

- You are comfortable with slower visible progress at the beginning

- You are very numbers-driven

- Saving money on interest is your top priority

- You can stay consistent without needing early wins

The avalanche method is more efficient mathematically, but it does require patience.

Snowball vs Avalanche Method: Which debt payoff method is better for you?

From a purely mathematical standpoint, the avalanche method is usually the most efficient debt payoff strategy. By targeting the highest interest rates first, it typically saves you more money over time.

That said, the best debt payoff method is not the one that looks best on paper. It is the one you will actually stick with.

There is no one-size-fits-all answer when it comes to choosing a debt payoff method. Both methods work. The difference comes down to how you stay motivated and how you prefer to see progress.

If motivation is your biggest struggle, the snowball method often makes more sense. Paying off smaller balances first can make the process feel more manageable, even if it is not the most efficient option mathematically.

If discipline comes easily to you and saving money on interest is your top priority, the avalanche method may be a better fit. By focusing on the highest interest rates first, it typically saves more money over time, but it requires patience.

Ultimately, the goal is not to choose the “perfect” method. The goal is to choose one method and give it time to work. A plan you can follow consistently will almost always beat a plan you abandon halfway through.

Want a Clear Debt Payoff Plan Without Doing the Math Yourself?

Comparing the snowball and avalanche methods can feel confusing.

Balances, interest rates, and payment amounts all change the outcome, and when you are looking at your own numbers, it’s not always obvious which option makes the most sense.

This is where seeing everything laid out clearly can help.

If you want a simple debt payoff calculator that does the math for you, my debt payoff spreadsheet helps you do exactly that. You enter your debts, choose between the snowball or avalanche method, and the spreadsheet runs the numbers for you.

With it, you can:

- Compare the snowball vs avalanche method side by side

- See how long each method would take to pay off your debt

- See how much interest you would pay with each option

- Adjust extra monthly payments and see how they affect your debt-free date

- Track your balances as you make progress over time

Instead of guessing or trying to calculate everything yourself, the spreadsheet shows you how each option plays out with your numbers. That way, you can choose a plan you feel confident sticking with.

Whether you are still deciding between methods or already know which one you want to use, having everything in one place can make the process feel more manageable.

Frequently Asked Questions

Which payoff method saves more money?

In most cases, the avalanche method saves more money because you are paying off high-interest debt first. This reduces how much interest builds up over time, especially if you have credit cards with very high rates.

That said, saving money only matters if you can stick with the plan. A method you follow consistently will almost always outperform a “perfect” method you abandon.

Which debt payoff method pays off debt faster?

That depends on your balances, interest rates, and how much extra you can put toward debt.

For some people, the snowball method feels faster because smaller balances are paid off early. For others, especially if a large portion of their debt has high interest rates, the avalanche method can shorten the overall payoff timeline by reducing interest faster.

Is the snowball method a bad idea if it costs more in interest?

No. If the snowball method helps you stay consistent and avoid giving up, it can still be a smart choice. For many people, early progress and motivation are what make paying off debt possible in the first place.

A plan you can stick with is better than a plan you do not follow.

Can You Switch Debt Payoff Methods?

You can, but it usually works best to pick one method and give it an honest try for a few months, since consistency is what creates progress.

That said, if you start to feel stuck or discouraged, switching methods can help you stay on track. The goal is to keep moving forward with a plan.

What to Do Next

Choosing between the snowball and avalanche method is an important step, but it is just one step. Progress comes from picking a plan, sticking with it, and letting momentum build over time.

Pick the method that feels manageable and you can commit to it long enough to see progress. Adjustments are normal, and steady progress always counts.

If you want a simple way to turn your choice into a clear plan, my debt payoff spreadsheet works as a debt payoff calculator by creating a personalized payoff plan based on your budget. It lets you compare the snowball and avalanche methods and track your progress as you go.

And if you are specifically working on credit card debt and want to better understand how interest affects your balances and payoff timeline, start with my guide on how to pay off credit card debt step by step.