Do you ever wonder where your money goes each month? Struggling to save & living paycheck to paycheck? Zero Based Budgeting (ZBB) can help!

I’ve tried many budgeting methods, but nothing has been as effective as Zero-Based Budgeting (ZBB).

What is Zero-Based Budgeting (ZBB)?

Unlike traditional budgeting methods, With Zero-Based Budgeting (ZBB), every dollar has a purpose, helping you take control of your finances and finally understand where your money is going.

With this method, you make a pre-plan of where to allocate every dollar of your income to specific spending categories or savings goals. The idea is not to “spend” all of your money. Rather, by assigning every single dollar a purpose, you’ll know exactly where your money is going. Your income minus your total expenses should always equal zero. This forces you to be intentional with your money and ensures every dollar has a purpose.

The Advantages:

- See Your Money Clearly: ZBB forces you to take a deep dive into your income and spending. This detailed breakdown helps you understand exactly where your money goes.

- Prioritize Your Goals: By allocating every dollar with ZBB, you take control of your spending and ensure your top financial goals, like saving for a vacation or paying off debt, come first.

- Stop Unnecessary Spending: Knowing where every dollar goes discourages impulse buys. ZBB encourages smarter choices with your money.

- Crush Debt Faster: With ZBB, you’ll see exactly how much you can realistically allocate towards your debt repayment. This empowers you to potentially set aside additional funds, like an extra $100 a month for credit cards, to become debt-free quicker.

- Take Control: With ZBB, you control your finances, not the other way around. You decide where your money goes, giving you a sense of power and security.

The Potential Challenges:

Zero-Based Budgeting gives you control of your money, but it requires commitment. We’ll cover some things to keep in mind.

- Time Commitment: Setting up ZBB initially requires time and effort. You’ll need to gather financial information, categorize expenses, and create a spending plan.

- Discipline Required: Sticking to your ZBB plan might require adjustments to your spending habits. Impulse purchases can derail your progress, so staying disciplined is key.

- Finding Your Balance: The detailed focus on every dollar can feel overwhelming at times. Remember, ZBB is about control, not restriction. Find a balance that works for you.

- Consistency: ZBB isn’t a “set it and forget it” method. You’ll need to review your budget regularly, adjust categories as needed, and adapt to changing financial circumstances.

It’s all about finding a ZBB plan that fits your lifestyle and goals, making managing your money and financial goals realistic and sustainable.

How Zero-Based Budgeting Works: A Step-by-Step Guide

Step 1: Gather Your Financial Information

Get a clear picture of your financial situation by gathering your bank statements, pay stubs, and any recurring bills for the past 3 months.

Step 2: Create Your ZBB Plan

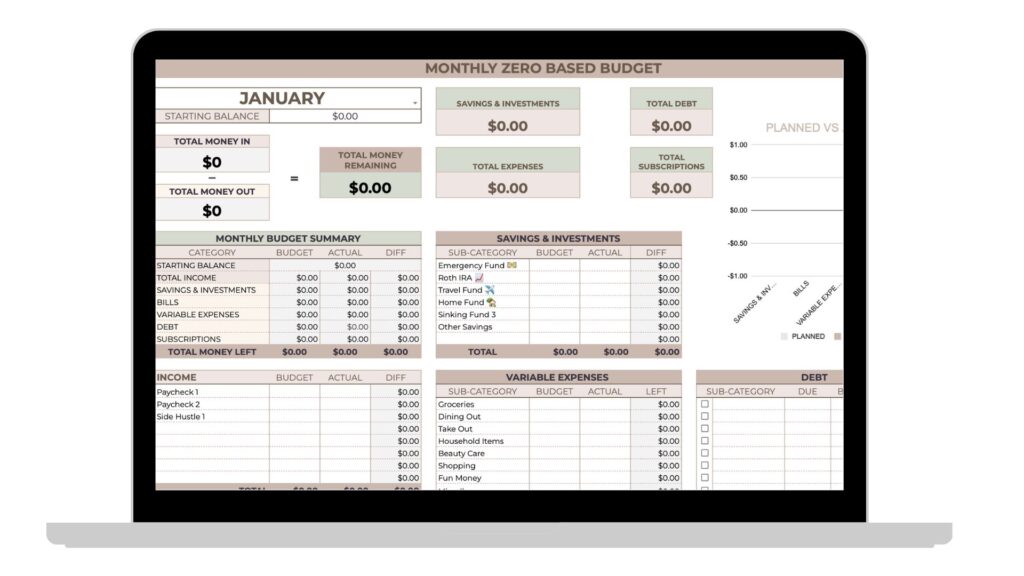

Now that you have your financial information, it’s time to build the foundation of your ZBB plan. Here is where you’ll create your budget categories. You can use a spreadsheet, a budgeting app, or even a pen and paper for this step.

Want to get a head start on creating your ZBB? Download your Free Zero-Based Budget Template (Google Sheet) here!

- Determine your monthly income sources: At the top of your sheet, list your monthly sources for a typical month, such as paycheck 1, paycheck 2, or side hustle income.

- Determine your monthly savings and investments goals: This could include an emergency fund, retirement savings, or short-term goals like a vacation.

- Determine your monthly expenses: Create a list of all your spending and categorize them into fixed and variable expenses.

- Fixed Expenses: These are recurring bills that stay relatively consistent each month, such as rent/mortgage, utilities, and subscriptions.

- Variable Expenses: Includes expenses that can fluctuate each month, such as groceries, dining out, entertainment, and shopping.

- Determine your monthly debt obligations: List all your existing debts, such as credit cards, student loans, car loans, or any other outstanding debts.

Step 3: Allocate Every Dollar to Your Budget Categories

Now that you have your income, savings goals, debt repayments, and spending categories identified, it’s time to pre-plan where every dollar of your income will go. Here, you’ll focus on the “Planned” section of your ZBB.

- Determine your monthly income: List your planned monthly take-home pay (after taxes) from all sources for a typical month.

Allocate Your Income:

- Savings and Investments: Allocate money towards your planned monthly savings goals (Example: $200 for your emergency fund, $500 for your retirement savings, or $300 for travel fund).

- Fixed Expenses: Allocate money to each fixed expense category you identified (e.g., rent/mortgage, utilities, subscriptions).

- Variable Expenses: Allocate money to each variable expense category you identified (e.g., groceries, dining out, entertainment, shopping). Be honest with yourself! Review your bank statements, pay stubs, and recurring bills for the past 3 months to get an honest picture of your current spending habits.

- Determine your monthly debt payments: List your minimum payments on credit cards, student loans, or other debts for the month.

Here’s how ZBB works:

Now that you’ve pre-planned what you’re going to do with all your income, all your income minus everything you allocated your money towards (savings, investments, expenses, and debt repayments) should equal $0. This is how a ZBB works- every dollar has a purpose!

If your total allocated amount for expenses is more than your income, you’ll need to adjust your ZBB spending plan. This might involve reducing spending in some categories or finding ways to increase your income.

Step 4: Track Your Spending and Review Regularly

Now that you’ve allocated every dollar of your income, here’s why tracking and reviewing your spending are essential:

- Track Your Actual Spending: Throughout the month, track your actual spending compared to your allocated amounts in each category (planned vs. actual). You can use a budgeting app, this FREE Zero-Based Budget Google Sheets Template, or even simple pen and paper notes for this.

- Review Regularly: Set aside some time each week or bi-weekly to review your spending progress. Are you staying on track with your planned budget? If you’re not, you’ll need to adjust your spending plan. This might involve reducing spending in some categories or finding ways to increase your income.

- Be Flexible: Unexpected expenses can arise, and ZBB is an ongoing process. If there are significant differences between your “planned” and “actual” spending, make sure to adjust your allocations for your next month’s budget. The key to success is to be aware of your spending and make adjustments as needed to ensure your ZBB plan aligns with your financial situation and goals.

Remember, budgets aren’t perfect, especially in the beginning. You will likely need to adjust and tweak your ZBB plan until you find a realistic and sustainable system that works for you. Don’t be discouraged if it takes some practice to find your budgeting mojo. The key to successful ZBB is consistent tracking, reviewing, and adapting your plan as needed. And of course, always make sure to celebrate your success, no matter how big or small.

Download your FREE Zero-Based Budget Template (Google Sheet) today and get started on your budgeting journey!

Have questions about implementing Zero-Based Budgeting? Leave a comment below!