Are you looking for ways to make your savings grow faster?

This post is all about High-Yield Savings Accounts (HYSAs) – a special savings account for growing your savings faster. We’ll break down what HYSAs are, how they benefit you, and why they’re perfect for building your emergency fund and short-term savings.

What is an High Yield Savings Account?:

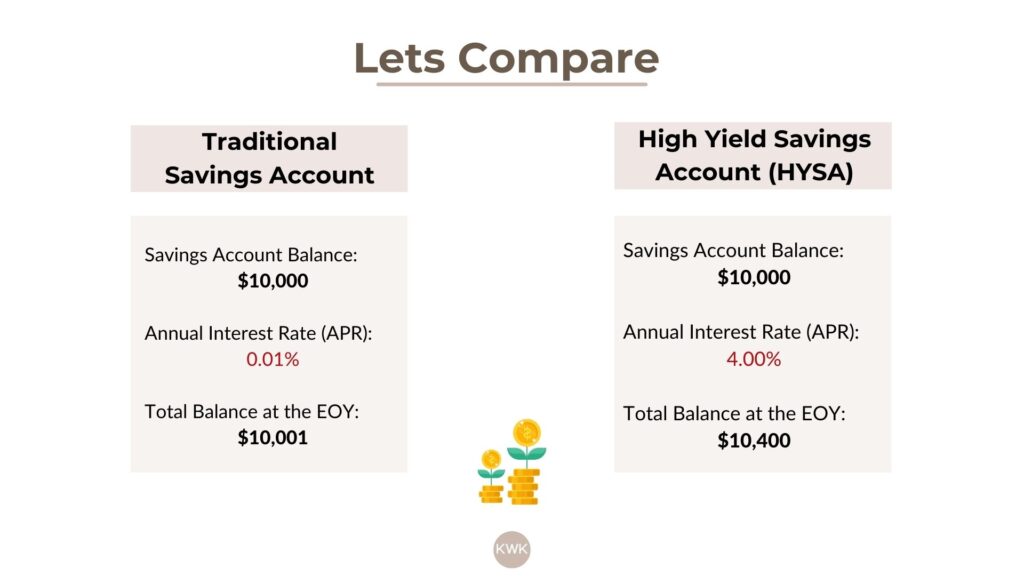

A high-yield savings account (HYSA) is a savings account that offers a considerably higher interest rate than traditional savings accounts.

Traditional accounts typically offer minimal interest, so your money grows slowly. However, with HYSA’s offering a higher interest rate, your money grows faster, helping you reach your savings goals quicker and without any extra effort from you.

Why Use a High Yield Savings Account?:

There are several reasons why HYSAs are a great choice for growing your savings:

- Grow Your Savings Faster with HYSAs: Even a small increase in the interest rate offered by an HYSA can make a big difference, especially for short-term goals like a vacation, car down payment, or a new appliance. Those little bits of interest add up quickly!

- Easy Access: Most HYSAs allow you to easily access your money when needed. There might be a short wait of 1-3 business days for transfers to be accessible, but it’s a small trade-off for faster savings growth!

- Secure Savings: HYSAs are typically insured by the FDIC (Federal Deposit Insurance Corporation) up to a certain amount, giving you peace of mind knowing your money is safe.

Disclaimer: Interest rates are subject to change and can fluctuate over time. The example provided in the table is for illustrative purposes only. The actual interest earned on a savings account will depend on the specific interest rate offered by the bank or institution and the length of time the money is deposited.

Disclaimer: Interest rates are subject to change and can fluctuate over time. The example provided in the table is for illustrative purposes only. The actual interest earned on a savings account will depend on the specific interest rate offered by the bank or institution and the length of time the money is deposited.

Now that you understand the benefits, here are a few key things to consider when choosing one:

- Interest Rate: Compare rates from different banks and online institutions to find the highest yield.

- Minimum Balance Requirements: Some HYSAs require a minimum balance to avoid monthly fees, look for those that don’t require this.

- Account Features: Look for features you’ll use often, like mobile banking and a user-friendly app. Read online reviews to see what other users are saying.

Once you’ve chosen a HYSA, opening an account is usually quick and easy, often done entirely online. Here’s a quick how-to video showing you how to open an HYSA account in less than 60 seconds.

Are HYSA Right for You?

HYSAs are a fantastic option for building your emergency fund and saving for short-term goals (aka sinking funds). They offer faster growth for your money thanks to higher interest rates, helping you reach your goals quicker and with easy access to your funds when needed.

However, if you’re saving for a long-term goal like retirement, you might want to explore other investment options that offer potentially higher returns (but also come with more risk).

Have any questions about HYSAs? Leave a comment below and let’s chat!